An Effective Guide on Absorption Costing: Advantages & Examples

Absorption expenses are easy to track because small businesses often do not have a large number of things. It further allows companies to sell their goods at more realistic pricing and profit margin. To put it another way, all manufacturing costs are absorbed into the price of the finished goods. Companies can use absorption, variable, or throughput costing for internal reports. The U.S. Securities and Exchange Commission (SEC) and GAAP are primarily concerned with external reporting. When under or over absorption is encountered, it is normally dealt with in one of two ways.

Inclusion of fixed costs in the cost is not reasonable:

The following is the step-by-step calculation and explanation of absorbed overhead in applying to Absorption Costing. This method of overhead absorption refers to the application of overheads as a percentage of direct labor. The process of such charging to or recovering of the overheads in the cost of production is called overhead absorption.

Allocation of Variable Manufacturing Overhead

(g) This cost-finding technique results in the under-or over-absorption of industrial overhead. Overhead Absorption is achieved by means of a predetermined overhead abortion rate. Therefore they have to be distributed to cost centers on some sharing basic like floor areas, machine hours, number of staff, etc. Once you complete the why you should hire an accountant for your personal finances allocation of these costs, you will know where to put these costs in the Income Statements. These materials were downloaded from PwC’s Viewpoint (viewpoint.pwc.com) under license. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

What’s the Difference Between Variable Costing and Absorption Costing?

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This method is suitable when the output is uniform in size and quality.

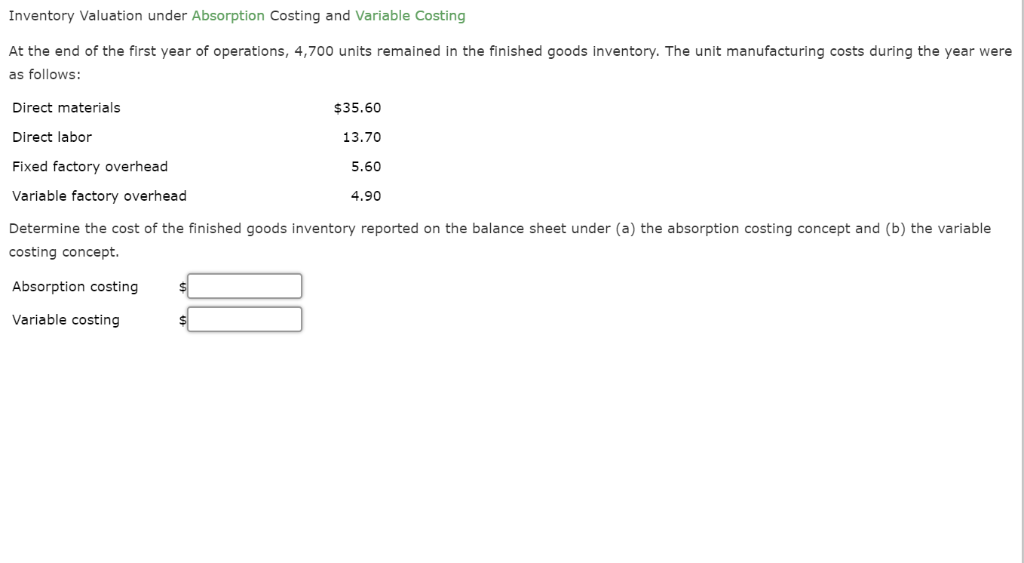

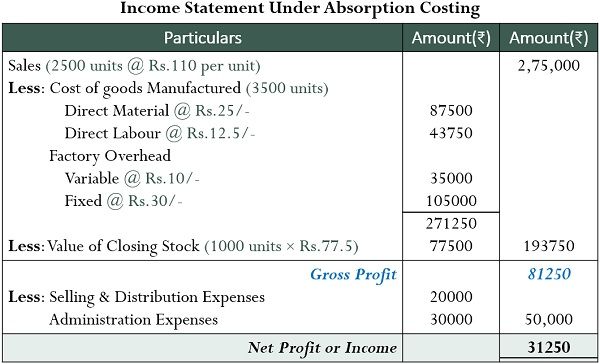

These costs are directly traceable to a specific product and include direct materials, direct labor, and variable overhead. Absorption costing, also known as full costing, is an accounting method that allocates all direct and indirect production costs to the cost of goods sold (COGS) and ending inventory. Depending on whether fixed manufacturing costs are assigned to units or not, there are two possible approaches to finding cost of units produced, namely absorption costing and variable costing (also called marginal costing). In conclusion, absorption costing is a fundamental accounting method that provides a comprehensive view of the total cost of production by allocating both variable and fixed manufacturing overhead costs to products or services.

This cost includes both variable costs (direct materials, direct labor, and variable manufacturing overhead) and a portion of the fixed manufacturing overhead (which is allocated based on the number of units produced). Under absorption costing, all manufacturing costs, both direct and indirect, are included in the cost of a product. Absorption costing is typically used for external reporting purposes, such as calculating the cost of goods sold for financial statements. It is also possible that an entity could generate extra profits simply by manufacturing more products that it does not sell. A manager could falsely authorize excess production to create these extra profits, but it burdens the entity with potentially obsolete inventory, and also requires the investment of working capital in the extra inventory. Under generally accepted accounting principles (GAAP), absorption costing is required for external financial reporting.

- Since absorption costing requires the allocation of what may be a considerable amount of overhead costs to products, a large proportion of a product’s costs may not be directly traceable to the product.

- It gives reasonably accurate results when the quality and prices of raw materials do not differ substantially.

- Under absorption costing, the inventory carries a portion of fixed overhead costs in its valuation.

- The steps required to complete a periodic assignment of costs to produced goods is noted below.

- Absorption costing results in a higher net income compared with variable costing.

- However, ABC is a time-consuming and expensive system to implement and maintain, and so is not very cost-effective when all you want to do is allocate costs to be in accordance with GAAP or IFRS.

Both costing methods can be used by management to make manufacturing decisions. Both can also be used for internal accounting purposes to value work in progress and finished inventory. This is the allocation of the cost of machinery and equipment over their useful life.

While both methods are used to calculate the cost of a product, they differ in the types of costs that are included and the purposes for which they are used. The differences between absorption costing and variable costing lie in how fixed overhead costs are treated. Under generally accepted accounting principles (GAAP), absorption costing is required for external reporting. Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory.